Are you presently looking to influence the most you could potentially use together with your newest income? If yes, you are better off comprehending that the quantity hinges on numerous products. Your earnings is not the just determining foundation. More over, every lender enjoys a different algorithm and you will laws and regulations to estimate the brand new limit credit matter having certain paycheck. Hence, the quantity you could use will vary off bank to help you financial.

Read on this web site for additional information on figuring your maximum borrowing capability. Your blog also answer questions related to a consumer loan to your a great 50,000 paycheck .

Restriction Personal loan Getting 50,000 Paycheck

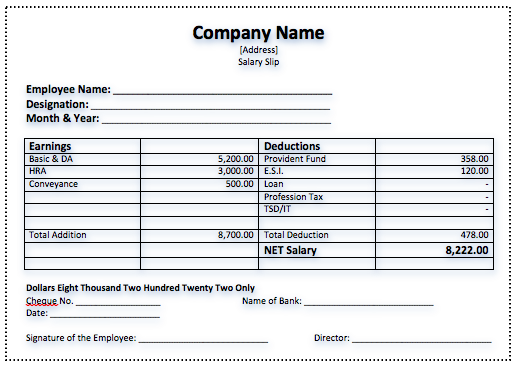

Most loan providers use the multiplier method to assess the most personal mortgage for a great 50,000 paycheck . It involves coping with a predetermined multiple on the paycheck amount.

According to the lender, brand new numerous will be ranging from 10 and 24. The fresh new table below provides you with a reasonable idea of brand new restrict personal loan having an excellent fifty,000 income.

How to Estimate The Maximum Borrowing Strength

The factors on which the utmost unsecured loan to own a beneficial 50,000 income utilizes are how much you make, your credit score, in addition to variety of financing you might be trying to get.

- Income

Your revenue establishes your investing capability. A lender is happy to financing you a price you to you can conveniently pay off along with your money at that time out-of application.

- Work Condition

The work condition has an effect on your borrowing from the bank capacity. Lenders are more comfy clearing applications out of people with a frequent money. Your credit capacity could be significantly all the way down if you don’t have one to. In some instances, lenders may refute apps out-of people rather than a frequent earnings. This occurs if exposure is deemed to-be way too high.

- Credit rating

When you have an effective borrowing history, depicted by a credit rating more than 800, you are able to use much more.

- Age

While drawing near to retirement age otherwise their typical money usually end otherwise fall off, your credit capacity will drop off somewhat.

If you would like determine how much cash you can buy while the a personal loan on an excellent 50,000 salary , the simplest way is with a finance calculator. Its an internet device which can be used to decide how much cash you can obtain predicated on your income, assets, or other points.

Strategies for a silky Personal loan Application

If you curently have a lender happy to provide your money, you might apply for a personal bank loan into the a fifty,000 paycheck . There are several what things to note beforehand applying getting financing.

- Be sure to has an itemised listing of your personal debt and you will costs. Their financial can get request they inside app techniques. These records are necessary to workout your own spending strength. It plays an important role during the deciding what kind of cash the fresh bank is give you without causing a hefty danger of default. With these records compiled can make the program procedure convenient. Be sure to provides an in depth anticipate how you will pay off people remaining loans. It is one of several concerns the loan broker may ask you for the application techniques.

- Aside from these types of, you want a collection of data. They might be:

- An authorities-approved photos title card. You should use the Aadhaar Cards, operating licence or Voter ID for this function.

- You will also have to provide evidence of your earnings. Income glides are great for this objective. However, some lenders also can require a copy of the passbook.

- Simultaneously, you’re going to have to establish target proof and you can, in some instances, a beneficial terminated cheque. It is to prove that you have a dynamic bank account.

Rates into a personal loan

The easiest way to contrast a consumer loan to a beneficial 50,000 income is to try to look at the interest rate. When considering rates, you need to look at the fees time of the loan.

Short-term finance may have a higher rate of interest, when you find yourself long-label finance may have a lesser interest. Personal loans are usually offered by high rates of interest as compared to other sorts of loans, for example household and you can training funds. There is also a fairly faster payment period.

Rates of interest private finance into the a great 50,000 salary start from financial so you can lender. For this reason, examining with many different lenders about their loan offers is key in advance of you begin the application. In that way, discover the very best deal for your self.

Loan providers have a tendency to promote all the way down rates to possess financing throughout joyful season. You might benefit from eg potential when you find yourself looking to that loan.

Cost Schedule to possess a personal bank loan

Once you borrow money off a loan provider, you should make monthly payments before financing was paid off. The borrowed funds terms offered by extremely lenders includes the newest fees schedule. The fresh new installment plan having a consumer loan will include the brand new monthly payment number, if repayments start therefore the moratorium months, if the applicable.

Along the brand new payment agenda will additionally count on new sort of mortgage you take. Very highest money are certain to get a phrase between ten so you’re able to 30 years. In the case of a personal bank loan, the fresh cost schedule is significantly reduced. The real date, as mentioned, will depend on how much cash you happen to be borrowing from the bank. However you will have some say for the repairing the borrowed funds installment plan. Yet not, you will have to come up with advice during the broad details the lender has put.

End

With more digitisation when you look at the financial, you can get unsecured loans to your a 50,000 salary on line. All of the lenders provide the accessibility to on line applications. Best lenders also have financing and you may EMI calculator. You can use them to dictate the borrowed funds you may get for the internet salary. Apart from the noticeable gurus, this will help https://paydayloanalabama.com/clanton to you see whether or not you could pay off the financing on the specified day.

To find out the best way to work with by using EMI calculators, try usually the one developed by Piramal Loans . You can read their blogs having a much deeper comprehension of just how such hand calculators work.